The onset of an intensifying global trade war has sent shockwaves through financial markets and thrown corporate America into a state of turmoil. As tensions continue to rise, the implications for the global economy appear increasingly precarious. In an effort to provide clarity and insight into these complex developments, DealBook has reached out to a diverse group of economists, investors, and other experts to forecast the potential outcomes and strategic responses we might expect in the near future.

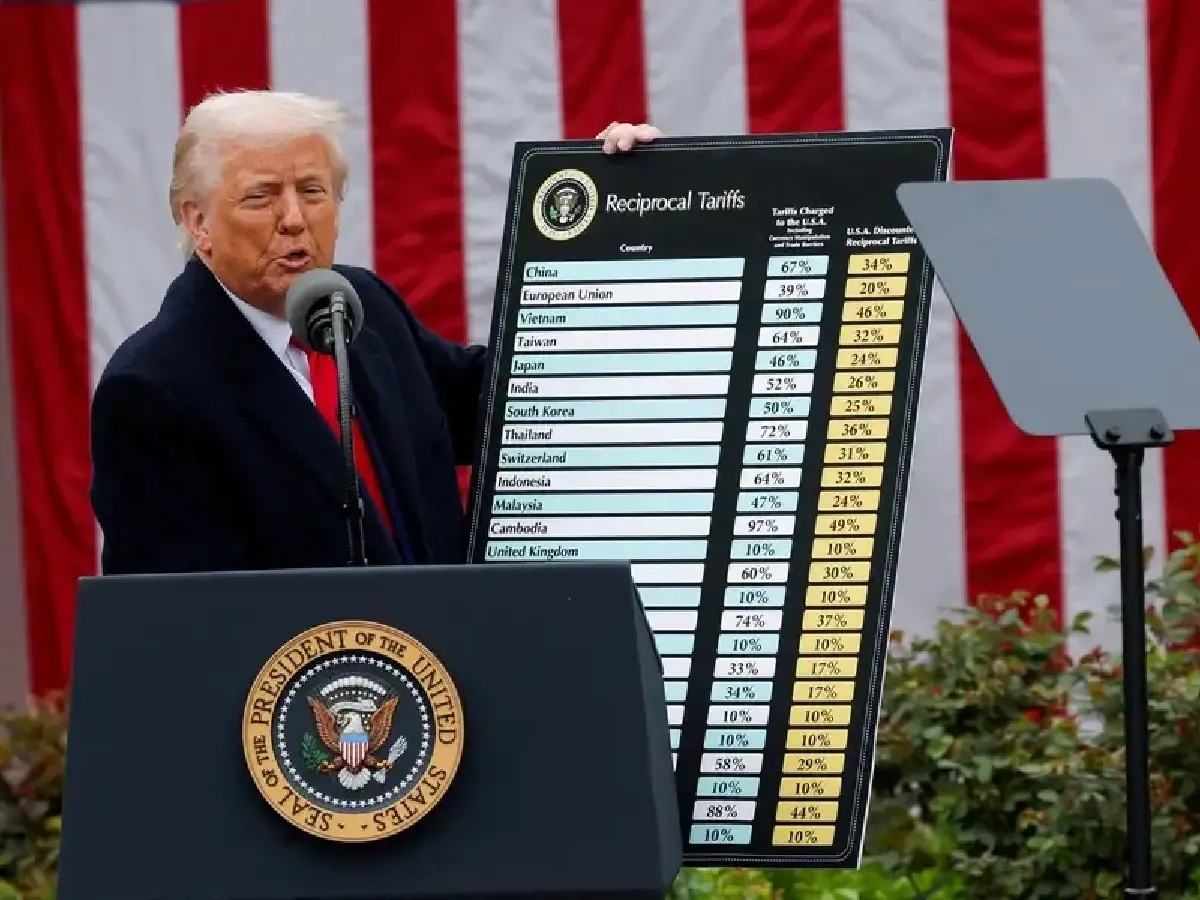

The genesis of the current trade war can be traced back to a series of aggressive trade policies, including tariffs and trade barriers imposed by major economies, aimed at protecting domestic industries. These policies have not only disrupted established supply chains but also sparked retaliatory measures from affected countries, leading to a cycle of escalating trade penalties. The result has been widespread uncertainty and volatility across global markets.

Financial markets have reacted sharply to each new development in the trade saga, with stock prices experiencing significant fluctuations. Many corporations have seen their operational costs rise as tariffs make raw materials more expensive and international sales more complicated due to countermeasures by other countries. This chain reaction is affecting everything from manufacturing to retail sectors, prompting a reevaluation of global market strategies and operations.

Economists are particularly concerned about the long-term impact of a prolonged trade war. According to Dr. Emily Johnson, an economist specializing in global trade, “A protracted trade war could significantly undermine global economic growth. Economies are interlinked through complex supply chains, and disruptions in these chains can lead to inefficiencies, higher costs, and ultimately slower growth.” Dr. Johnson suggests that prolonged trade tensions could lead to a sustained downturn in investor confidence, which could stymie investment and innovation.

Investors, too, are on high alert. Market strategist Michael Li comments, “The uncertainty generated by ongoing trade disputes has led to increased market volatility. Investors are understandably nervous, and many are reevaluating their portfolio exposures to mitigate potential risks.” Li advises a cautious approach, emphasizing the importance of diversification and long-term planning in uncertain times.

Beyond the direct economic and market impact, the geopolitical ramifications of a global trade war are also significant. As nations turn inward, seeking to protect their own industries, the potential for international cooperation on other critical issues, such as climate change and cybersecurity, may be compromised. This could lead to a fragmentation of global governance structures and a reduction in the collective ability to address global challenges.

In response to these mounting challenges, some experts advocate for a renewed commitment to multilateral dialogue and negotiation. Dr. Susan Choi, a professor of international relations, argues that “In a globalized world, unilateral actions are less likely to yield positive outcomes. Cooperative, multilateral approaches are essential for resolving trade disputes and ensuring stable economic and political relations.” Choi emphasizes the need for international institutions like the World Trade Organization to play a more active role in mediating disputes and facilitating dialogue.

As corporate America grapples with the chaos unleashed by the trade war, business leaders are also adjusting their strategies. Many are exploring alternative supply chains, considering local sourcing options, or delaying expansion plans. The overarching goal is to enhance resilience against the backdrop of trade unpredictability.

In conclusion, the escalation of the global trade war represents a critical juncture for the world economy. The path forward will require careful negotiation, strategic resilience, and a commitment to global cooperation. As markets continue to react and adapt, the insights from economists, investors, and other experts will be invaluable in navigating the complexities of this challenging economic landscape.