**Navigating New Trade Realities: Is it Time to Reconsider Investments in the U.S.?**

As the global business climate evolves, trade tensions are prompting investors and businesses worldwide to reevaluate their stakes in the United States. The changing dynamics pose serious questions: What are the implications for international investors and companies heavily invested in the U.S.? Could this herald a shift in the global economic landscape?

### Understanding the Shift in Trade Dynamics

Recent developments have underscored growing economic resistance against what some view as pervasive American influence in global trade. Several countries and economic unions have begun to question longstanding trade agreements and are contemplating more stringent measures that could affect companies operating in or with the U.S. This reevaluation can lead to significant shifts in how businesses operate internationally and the strategic decisions they must consider about their American investments.

### Why the Sudden Scrutiny?

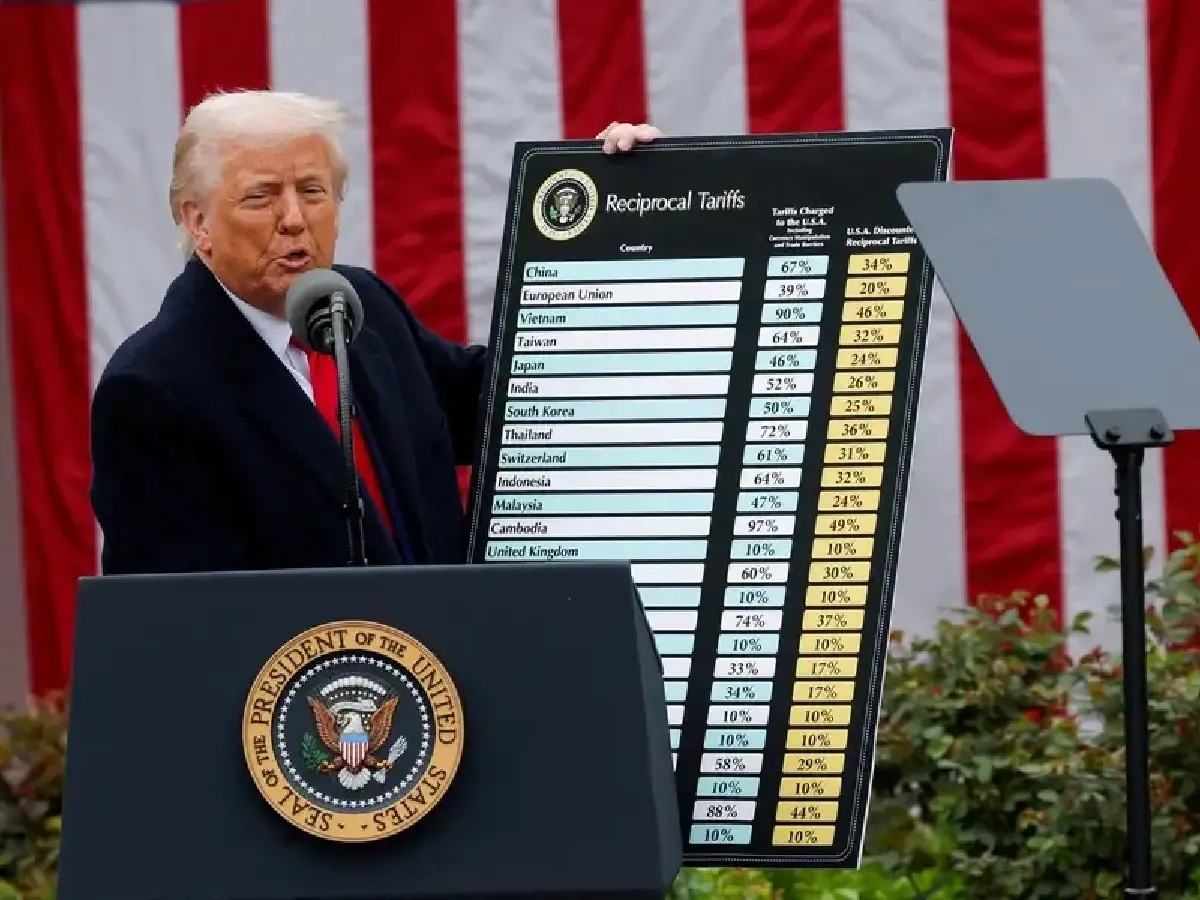

The ripple effects of trade disputes are not new but have been brought into sharp focus in recent months. Nations around the world are reassessing their economic policies and alliances, spurred by a desire to secure more favorable trade terms and enhance their national economic interests. This scrutiny often results in new tariffs, trade barriers, and renegotiated agreements, impacting global markets and investment strategies.

### The Impact on Global Businesses

For companies with significant investments in the U.S., the changing trade landscape can be particularly daunting. These businesses must navigate not only the immediate financial implications of tariffs and trade barriers but also longer-term strategic decisions about whether to continue expanding their American footprint or diversify their investments to other, potentially less volatile markets.

This strategic shift could involve moving parts of their operations or supply chains out of the U.S. to avoid tariffs, seeking new markets for their products, or even reassessing the viability of their business models in the face of changing global economic policies.

### What Does This Mean for Investors?

Investors are similarly affected. The uncertainty around trade policies can cause significant market volatility, which poses risks for both institutional and individual investors. Stocks in sectors like manufacturing, technology, and consumer goods might feel the most direct impacts, given their exposure to international trade dynamics.

### Looking Ahead: Strategies for Businesses and Investors

1. **Diversification**: Both companies and investors should consider diversifying their portfolios and operations across different geographical regions. This strategy can mitigate risk by reducing dependence on any single market.

2. **Market Analysis**: Continuous monitoring of global economic policies and market trends will be crucial. Staying informed will allow businesses and investors to react swiftly to changes in the trade environment.

3. **Flexibility in Investment**: A flexible investment strategy that can adapt to changing economic circumstances might offer protection against trade-related risks. This might involve temporary reallocation of resources or adjusting investment goals based on the prevailing economic climate.

### Conclusion: Embracing Change and Uncertainty

The growing trade tensions have made it imperative for businesses and investors to remain agile and informed. While the U.S. continues to be a significant player on the global stage, the changing economic policies and trade practices warrant a careful reassessment of how much to invest and where. As the situation evolves, keeping a close eye on developments and being ready to pivot strategies will be key to navigating this turbulent period in global trade.

In this ever-shifting landscape, finding balance and employing strategic foresight will determine how well businesses and investors can weather the storm of international trade tensions and capitalize on emerging opportunities in new markets.