## Unpacking the Shift in Tax Enforcement Strategy Under Trump’s Presidency

In recent developments, President Trump has announced a significant change in the approach toward tax enforcement, which marks a departure from the strategies formerly set out by the Biden administration. This decision comes amid various reactions and has stirred conversations around its impacts and implications. In this blog post, we examine the details and potential outcomes of Trump’s revised tax policies.

### Overview of the Biden Administration’s Tax Enforcement Plan

Previously, the Biden administration had laid out plans to increase tax revenue by amplifying enforcement measures. The strategy was aimed to tighten compliance and ensure that all taxpayers, particularly those at higher income levels, contribute their fair share. This approach was also seen as a method to bridge the tax gap and generate additional funds necessary for public services and infrastructure projects.

### Trump’s Change of Course

However, under President Trump’s new directive, there seems to be a shift away from the enforcement-focused tax strategy. Trump’s plan suggests a less aggressive stance on tax enforcement compared to the robust framework proposed by Biden. This change raises questions about the reasons behind the rollback and its implications on tax revenues and compliance.

### Analyzing the Potential Impact

**1. Impact on Tax Revenue**

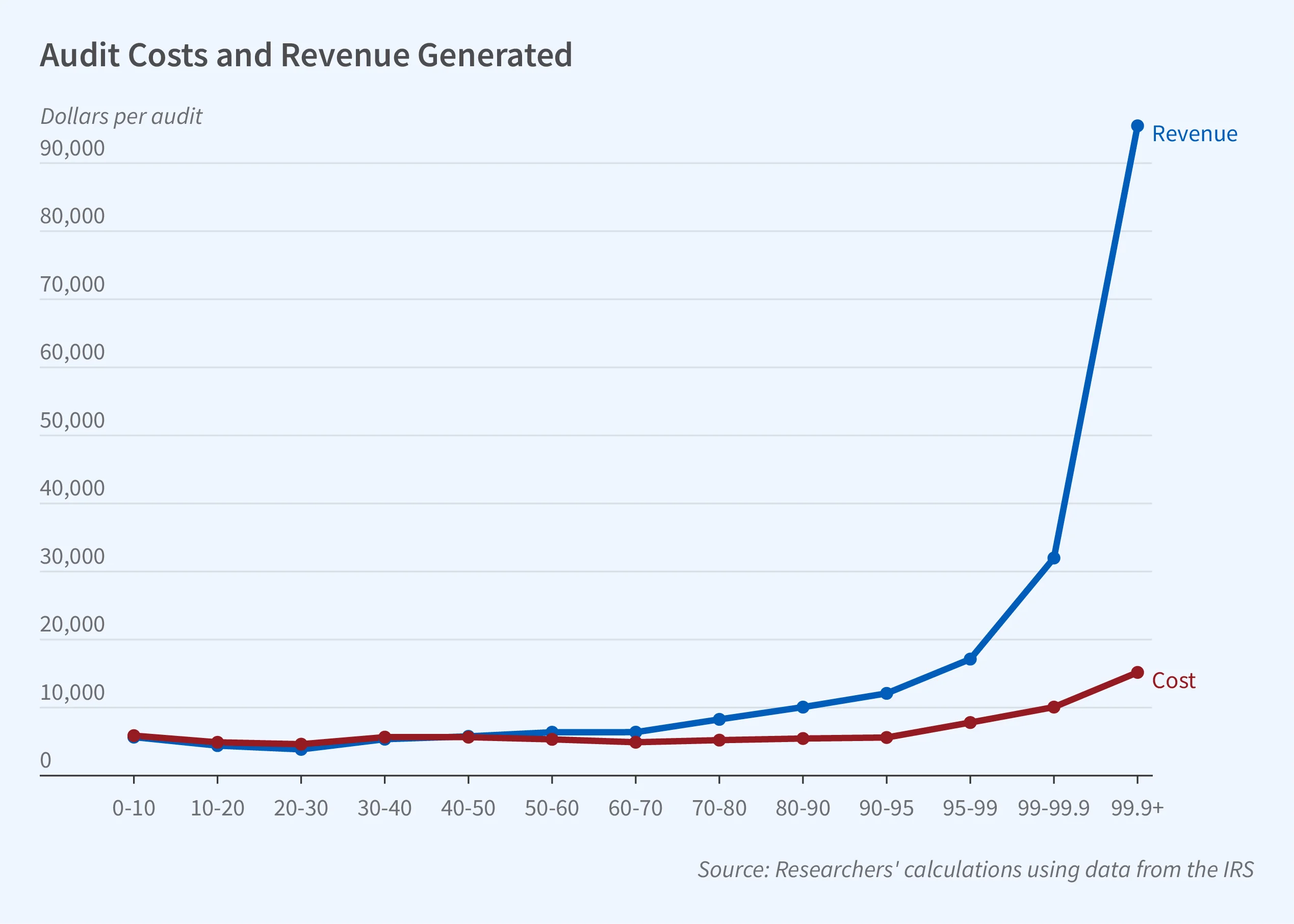

One of the primary concerns with reducing the intensity of tax enforcement is the potential decrease in tax revenues. Enhanced enforcement under the Biden plan was expected to increase government revenues, which could be allocated to various public initiatives. Trump’s approach might result in lower-than-anticipated revenue collections, which could affect funding for public services.

**2. Taxpayer Compliance**

Stricter enforcement typically encourages higher compliance rates. Relaxed measures could lead to a drop in compliance, as the perceived risk of facing penalties for evasion decreases. This aspect might encourage some taxpayers to take a lax approach towards their tax obligations, potentially increasing the tax gap.

**3. Economic Implications**

The broader economic impact is also a vital area of consideration. Efficient tax collection is crucial for maintaining the government’s ability to fund essential projects and manage national debts. Any reduction in enforcement that leads to decreased revenue might necessitate adjustments in public spending or changes in debt management strategies.

### Implications for Different Stakeholders

The change in enforcement strategy can have varied implications for different sectors of society:

– **For Individual Taxpayers:** Most ordinary taxpayers might not experience direct changes immediately; however, the long-term consequences of funding cuts to public services could eventually affect them.

– **For High-Income Individuals and Corporations:** This group might find a more favorable tax environment with less stringent enforcement, which could lead to lower tax burdens. However, it remains essential for these entities to practice responsible tax behavior to maintain public trust and avoid potential legal complications.

### Looking Ahead

As these changes unfold, it will be important to monitor the outcomes closely. Analysts and policymakers alike will need to assess whether the shift adequately supports the broader economic and social objectives or if adjustments are necessary to align with national fiscal responsibilities.

In conclusion, President Trump’s decision to reverse the Biden administration’s tax enforcement plan introduces a new chapter in U.S. fiscal policy. The effectiveness and impact of this strategy will only be measurable over time, and it is crucial for ongoing discussions and evaluations to ensure it serves the best interest of the country’s economy and its citizens.