### Navigating Financial Waters: Understanding the Impact of President Trump’s Protectionist Measures on Markets

The U.S. financial market has yet again found itself in turbulent waters, this time triggered by the latest protectionist measures implemented by President Trump. As concerns about a possible U.S. recession loom, investors are witnessing a sharp decline in both stocks and bonds, highlighting the ripple effects of trade policies on market dynamics.

#### Exploring the Cause: Protectionist Policies

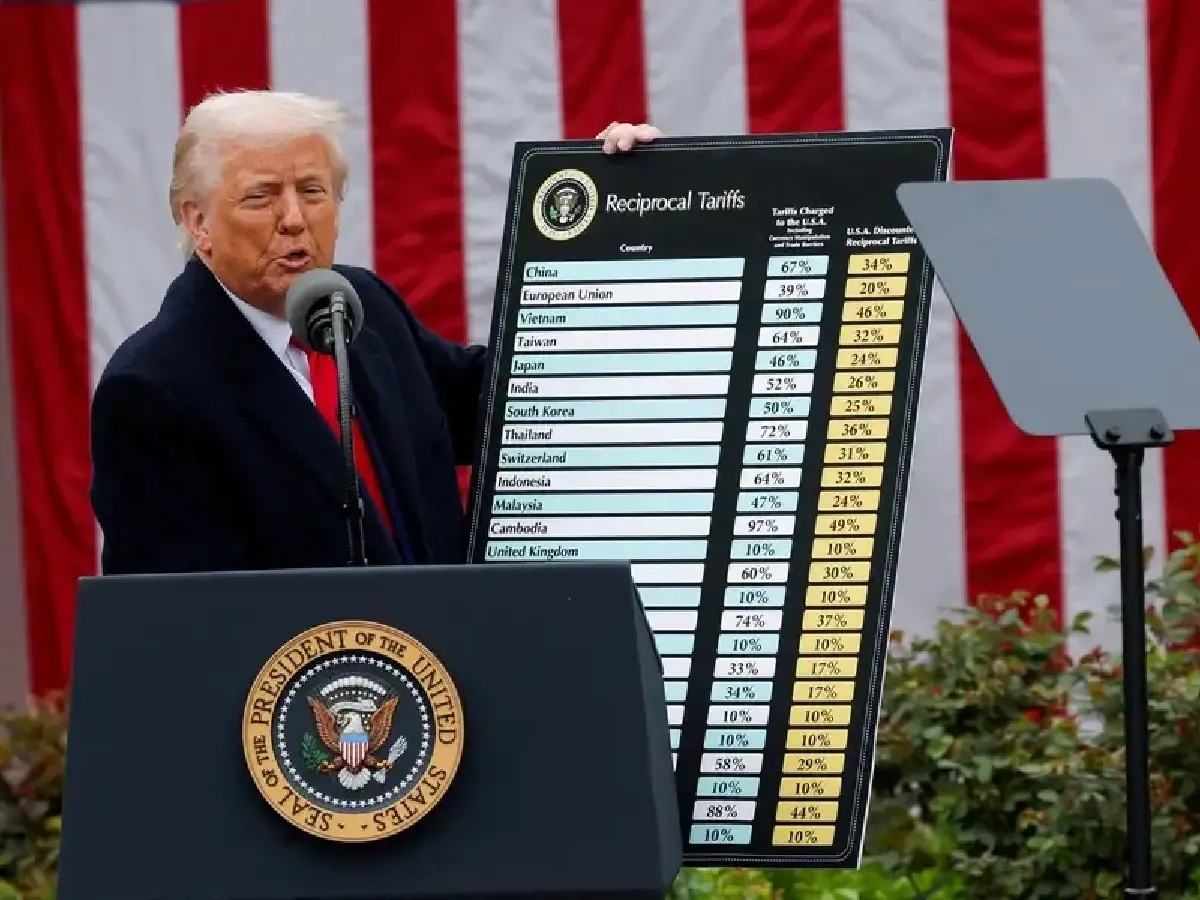

Protectionist measures generally involve policies that restrict foreign competition through tariffs, quotas, and other regulations. These are intended to support domestic industries, but they often lead to retaliatory actions from trading partners, thereby affecting global economic interactions. Recently, President Trump has enhanced these tactics, stirring considerable unrest among investors and drawing criticism from various economic sectors. This approach is viewed as a bid to bolster American industries, but the immediate repercussions are evident in the financial markets which are highly sensitive to policy changes.

#### Immediate Impact on Stocks and Bonds

The announcement of new tariffs and trade barriers has led directly to volatility in the financial landscape. Stocks, which represent shares of ownership in companies, have taken a significant hit as investors pull back, wary of the potential economic slowdown these policies might precipitate. Bonds, typically seen as safer investments during economic uncertainty, have also experienced a sell-off, suggesting a broader apprehension about the U.S. economy’s trajectory.

This simultaneous decline in both stocks and bonds is somewhat unusual as investors often turn to bonds as a safe haven when stocks are performing poorly. The current situation indicates a pervasive sentiment of caution, steering market participants to reconsider their risk exposure and investment strategies.

#### Growing Fears of U.S. Recession

The economic downturn hinted by the falling markets reflects growing fears of a possible U.S. recession. Recessions typically involve prolonged economic decline, and the anticipation of such a scenario can exacerbate market downturns. Investors’ confidence has been shaken by the uncertainty surrounding the trade policies and their long-term effects on global economic stability and growth.

In terms of economic indicators, the protectionist measures may potentially disrupt manufacturing, affect employment rates, and decrease consumer spending. These factors collectively contribute to economic contraction, which is why the specter of a recession becomes a concrete concern in light of aggressive trade restrictions.

#### Reacting to Market Trends: Insights for Investors

For investors, understanding the implications of political and economic changes on market trends is crucial. In the current climate, it is essential to stay informed about global economic policies and their potential impacts. Diversification of investment portfolios is frequently advised as a strategy to mitigate risks associated with the volatility caused by such geopolitical influences. Additionally, it may be prudent for investors to explore defensive stocks or sectors that traditionally show resilience in downturns, such as utilities or consumer staples.

#### Conclusion: Looking Ahead

The financial markets are often a reflection of broader economic sentiment, and the recent downturn triggered by protectionist trade measures is a clear indicator of the nervousness permeating global economics. As discussions and policies continue to evolve, monitoring these changes and understanding their implications will be vital for market participants. It remains to be seen how the U.S. will navigate these choppy financial waters and what measures might be put in place to stabilize the economy and reassure investors.

In summary, while the immediate effects of protectionist policies can be daunting, a wary yet informed approach can help in managing investments during such uncertain times. As always, keeping a close eye on economic developments and maintaining a well-thought-out investment strategy will be key in overcoming potential market challenges.