## Understanding the Impact: Trump’s Top Advisers Clash Over New Tariffs

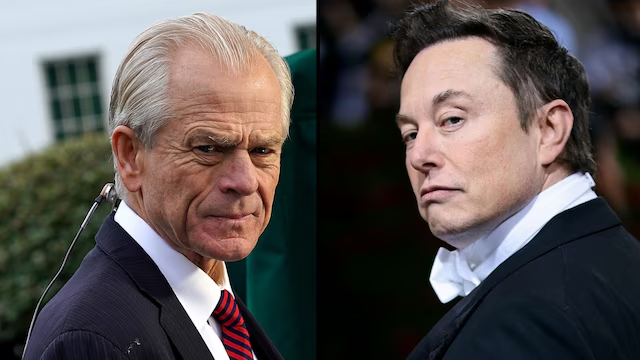

In the latest developments from Washington, a feud between two of President Trump’s primary advisers is casting a long shadow over the administration’s recent fiscal decisions. This internal conflict, centered around the imposition of new tariffs, has reverberated through global financial markets, triggering significant losses.

### The Core of the Conflict

The disagreements at the top echelons of Trump’s team primarily involve economic strategies, with the central issue being the new tariffs imposed by the administration. These policies are designed to support domestic industries by making foreign goods more expensive, theoretically boosting local businesses. However, the approach has been contentious, sparking debates among experts and policymakers about its potential long-term consequences.

### Market Reactions to New Tariffs

The immediate aftermath of the tariff announcement was a sharp downturn in global financial markets. Investors, already jittery about potential trade wars, responded negatively, fearing that the tariffs might hinder global trade. The ripple effects were seen across major stock exchanges, with indices in the U.S., Europe, and Asia all suffering declines.

#### Analyzing the Fallout

Financial analysts have been quick to point out that such dramatic market reactions are indicative of broader economic uncertainties spawned by these policies. The tariffs, while aimed at benefiting domestic manufacturers, could increase costs for consumers and businesses that rely on imported goods, leading to an overall slowdown in economic activity.

### Long-Term Implications for Global Trade

The broader implications of the U.S. tariff strategy extend beyond immediate market reactions. There is a growing concern among international leaders and economic experts that this move might undermine decades of global trade agreements. If other nations retaliate with their own tariffs, the result could be a trade war that stifles global economic growth.

#### Strategic Responses from Other Nations

Countries affected by the U.S. tariffs have begun to outline potential retaliatory measures. These responses could further complicate the situation, leading to a tit-for-tat escalation that would serve no one’s interests. The need for diplomatic negotiations and revisions in trade agreements is more crucial than ever to prevent a full-scale trade war.

### Looking Ahead: Navigating Through Economic Uncertainty

As the administration navigates these turbulent economic waters, the resolution of internal conflicts will be key to presenting a united front in global economic arenas. The ability of Trump’s advisers to reach a consensus on handling the fallout from the tariffs could determine the success of U.S. economic policies moving forward.

Furthermore, it is essential for the administration to engage with international partners to reassess and possibly recalibrate the current trade strategies. This approach would not only help in stabilizing the markets but also pave the way for sustainable economic policies that benefit multiple stakeholders in the global economy.

### Conclusion

The feud between President Trump’s top advisers over the new tariffs serves as a reminder of the complex interplay between domestic policies and global economic health. As the situation develops, it will be imperative for all parties involved to prioritize long-term gains over short-term victories, ensuring stability and growth in the global market landscape. Engaging dialogues, strategic partnerships, and a focus on comprehensive economic analysis will be key in navigating the challenges ahead.