Over the past few years, a significant shift has been observed in the way sportswear brands manage their production strategies. Initially, a primary driver for these changes was the imposition of tariffs on goods manufactured in China. These tariffs, part of broader trade tensions, encouraged many companies in the athletic apparel industry to seek alternative manufacturing sites outside of China to sidestep increased costs. However, this strategic pivot has led to unforeseen challenges as new tariffs begin to impact these alternative manufacturing hubs, complicating the global supply chain further.

In an era where economic diplomacy frequently influences corporate strategies, sportswear brands that once heavily relied on Chinese manufacturing began diversifying their production to countries like Vietnam, Bangladesh, and Indonesia. These nations offered competitive labor costs and were seen as viable alternatives to mitigate the risk of tariffs and reduce dependencies on any single source. The initial transition appeared to be a strategic victory for many brands aiming to maintain a competitive edge in the market through cost efficiency.

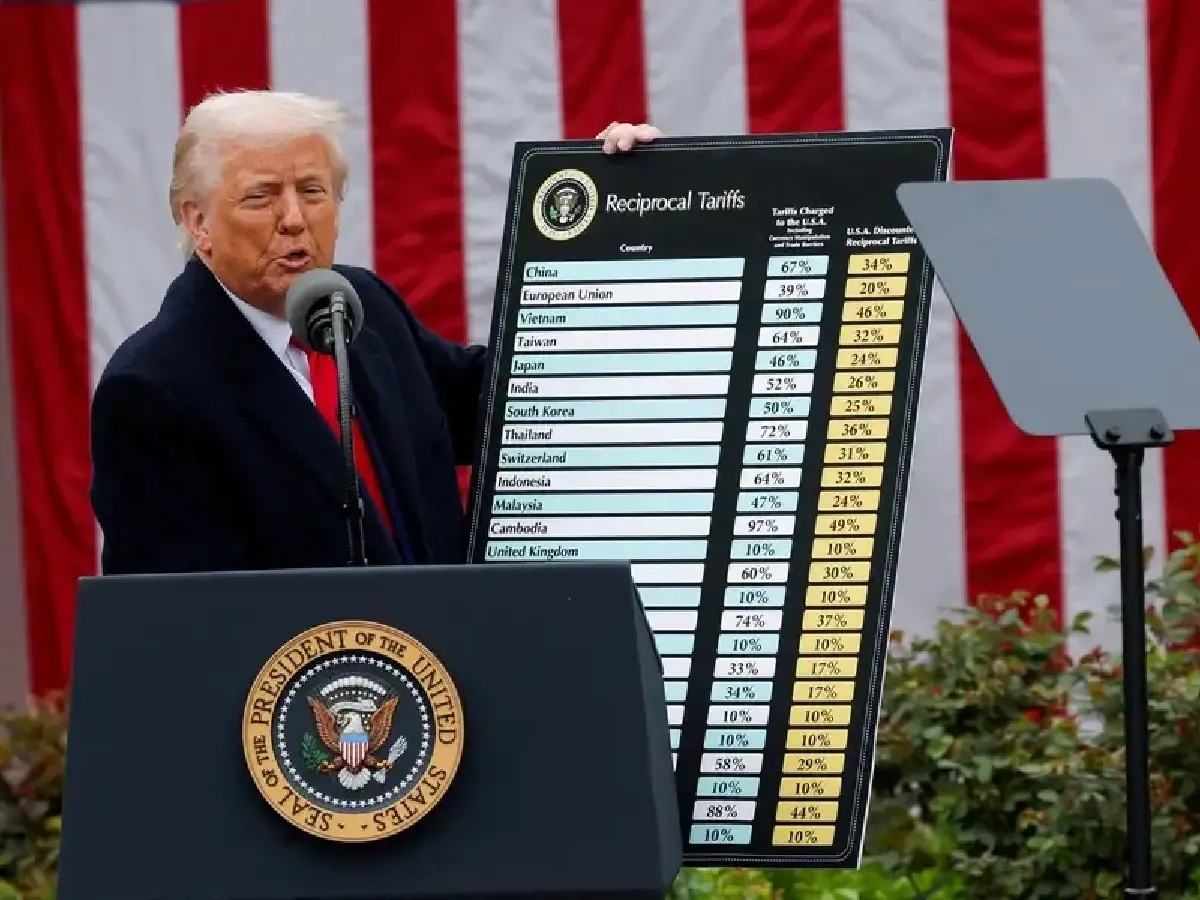

Nevertheless, the narrative took an unexpected turn when new levies were introduced, targeting these very alternative manufacturing hubs. The introduction of these new tariffs has thrown a spanner in the works, creating a complex scenario for sportswear companies. These brands are now grappling with increased costs in regions that were once viewed as safe havens from the economic impacts of trade wars.

The implications of these new tariffs are multifaceted. On one hand, increased production costs could lead to higher retail prices for consumers, potentially lowering demand and affecting overall sales. On the other hand, companies are pressured to reassess and possibly reconfigure their supply chains yet again, which could lead to operational disruptions and increased logistical costs.

Moreover, the volatility of international trade policies calls for a more agile approach to supply chain management. Companies must now consider the potential long-term sustainability of their manufacturing locations and anticipate shifts in policy that could affect their operations. This may involve investing in even more diversified approaches, including bringing some production closer to key markets – a strategy known as near-shoring – or exploring advanced manufacturing technologies like automation and robotics to lessen the labor cost component of their products.

The ongoing scenario also highlights the critical necessity for sportswear brands to strengthen their supply chain resilience. This involves not only geographic diversification but also improving visibility and control over their supply networks. Enhanced forecasting models and contingency planning will become increasingly important as brands navigate through the unpredictability of global trade dynamics.

Furthermore, there is a growing realization of the need for brands to engage more actively with international trade policy developments. By advocating for favorable trade conditions and participating in policy discussions, companies can better anticipate and influence the regulatory environment affecting their operations.

In conclusion, the dynamic landscape of international tariffs presents both challenges and opportunities for the sportswear industry. As companies contend with the current disruptions caused by new levies on previously favored production locales, a more strategic, resilient, and proactive approach to supply chain management is essential. Adapting to these changes will not only require operational agility but also a deeper engagement with the broader economic and political factors shaping global trade.